Universal Credit Payments Set To Decrease

The Department for Work and Pensions (DWP) has said it has begun contacting the six million people regarding the cut to the universal credit ‘uplift’ by the beginning of October 2021. People who have been eligible for the £20 a week top-up will soon see their universal credit payments decrease.

Universal credit made its first appearance in 2013 designed to streamline the UK’s different benefits into one payment. It is aimed at people of working age, although not everyone is eligible. The payment is aimed at people with £16,000 or less in savings, whether employed or unemployed. It is also dependent on other circumstances. If eligible, your payments will decrease the more you earn.

The payment is deposited monthly into a bank or building society account in England and Wales. Whereas people in Scotland have the option to receive it fortnightly. A claimant may be able to get a reduction in council tax and help to pay rent or childcare costs. It is worth noting that it may also negatively impact other benefits, such as tax credits. This may happen even if the application is not accepted.

The Government aims to have all claimants on the universal credit system by 2024.

Universal Credit Uplift

The government originally introduced the uplift at the start of the pandemic in 2020. It was designed to help struggling individuals, couples or families stretch their finances a little bit further at a very difficult time. A £20 increase per week was applied to the original payment over the peak months of the pandemic.

In April 2021, Chancellor Rishi Sunak extended for a further six months, alongside an extension to the furlough scheme. The continuation of the temporary £20 uplift has been a lifeline to millions of people claiming universal credit. Opposition and anger has met the decision to end the scheme by 6th October.

Both Citizens Advice and the Joseph Rowntree Foundation, a poverty research charity, have warned that removing the extra £20 a week aid will push millions across the UK further into debt. They have urged the government to make the extra £20 per week a permanent increase.

Up to 500,000 people will now be swept into poverty – including 200,000 children – according to the JRF. As many as 6 in 10 households will be affected by the decrease, losing approximately £1,040 a year per household. Citizens Advice warns the public that up to a third of people will fall into serious debt once it’s removed.

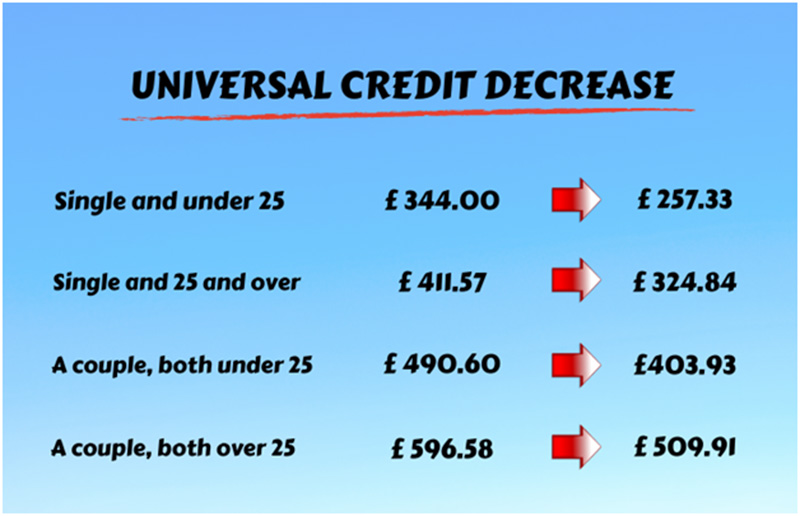

Work and Pensions secretary Thérèse Coffey has confirmed that the DWP is issuing notice to claimants. Depending on when they receive their payments, the last higher payment could be September 2021. You can see these changes below.

The changes in monthly payments from October 2021

PM Boris Johnson stated in August that he wishes to see people’s income rise ‘through their efforts rather than through taxation’. Effectively, putting focus on getting people back into employment.

But even people in full-time employment are struggling with their finances, often struggling to pay rent or afford food. The Institute for Public Policy Research found that 1 in 6 working households live in poverty (earning less than £18,000).

Findings show that many people cannot afford to buy property now, so are forced into rental properties. In addition, rental costs have seen a 48% increase over the past quarter-century, yet salaries have not risen anywhere near.

Fears that parents will have to choose between feeding themselves, their children, paying rent and bills are growing. Thérèse Coffey suggested that working an extra 2 hours a week would replace the extra £20 per week. She went on to explain that there are a record number of job vacancies. For working parents, they will also have to factor in 2 extra hours of childcare costs.

Health Secretary Sajid Javid has confirmed the decrease will go ahead. Rishi Sunak has denied that it will force more people into difficulty and debt.