National Insurance Contributions Set To Increase

The UK Prime Minister, Boris Johnson, has announced today, Tuesday 7th September, that National Insurance contributions will increase by 1.25% at the start of the new tax year in April 2022.

The proposed increase, hoping to plug the economy’s shortfall, has drawn backlash from fellow MPs saying that pledges made in the 2019 manifesto have now been broken.

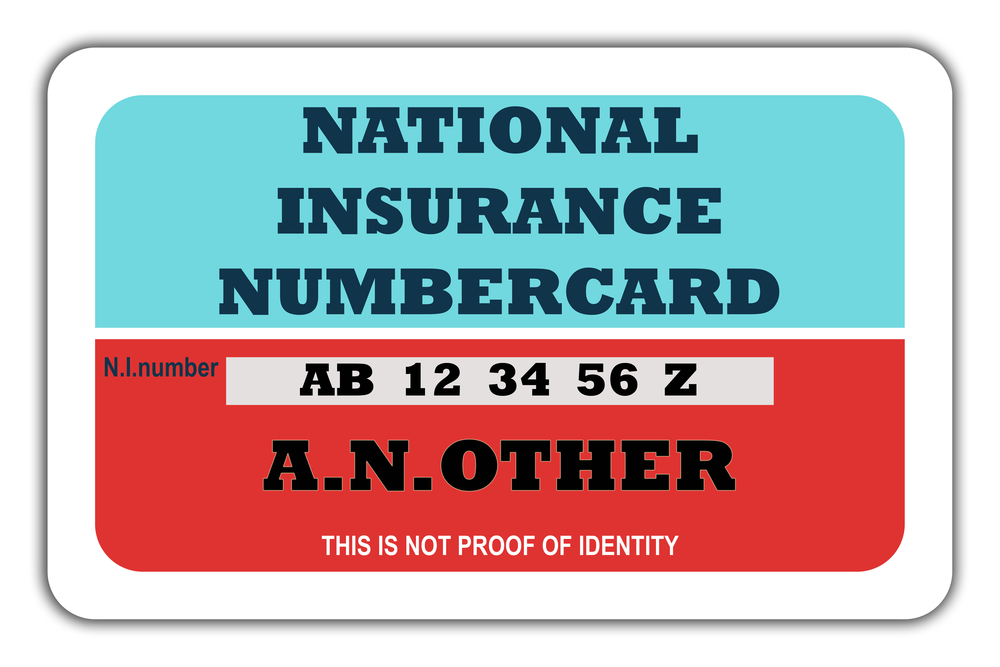

Firstly, what is National Insurance?

National insurance contributions are compulsory to anyone over 16 years of age earning more than £184 per week, or self-employed persons making a profit of £6,515 over the year. Paying this throughout your working life allows you to qualify for the state pension and other services if and when needed.

These contributions go towards particular state services, such as:

- The NHS

- State pension

- Unemployment and disability benefits

- Maternity pay

- Bereavement and sick pay

Once you reach state pension age, you stop paying National Insurance.

Why are the contributions being increased?

There is more than one reason for the hike in contribution payments. Firstly, the most obvious is the crippling effect that the pandemic has had on the NHS and the resulting backlog for patients. It’s estimated that the rise in tax may pump up to £11-12 billion back into the NHS to help stabilise the failing health service.

Secondly, the surplus tax will also be used to pay for social care reforms. This will include a greater provision of care homes and help with further care costs for those with disabilities. Social care, unlike the NHS, is not free of charge for everyone. Currently, only those with assets worth less than £23,250 are eligible for help. In turn, those not eligible with higher valued assets often find they are forced into selling properties to pay for such care – often hard-earned and ear-marked for an inheritance for their families.

Mr Johnson has stated “reform can no longer be ‘ducked’ and the elderly should not lose their life savings and homes due to the ‘bolt from the blue’ of dementia” and has made assurances that the increases will go directly to just the NHS and social care.

It is hoped that the reform will mean no one will have to pay more than £86,000 in total for their care, and anyone with assets totalling less than £20,000 will not need to contribute to their own care. Those with assets between £20,000 and £100,000 will still need to pay a percentage of the bill.

Why has the proposal met opposition?

Opinions remain strongly divided on the move, with the Prime Minister even facing anger from his own Conservative Party members.

One of the 2019 Manifesto Pledges was that tax, VAT and National Insurance would see no increases during Conservative power. In spite of these promises, no one could have foreseen the financial damage that the pandemic would bring. Vaccines minister Nadhim Zahawi stated that “no one wants to break a pledge, but the pandemic changed the parameters of the economy’s needs”. Furthermore, those costs do need to be recuperated.

There are strong opinions voiced about where the tax should be taken from, as opposed to a National insurance hike.

MP Jeremy Hunt voiced concerns that it will disproportionately affect younger and lower-income earners, yet admitted the sums needed to recuperate were eye-watering. Mr Hunt suggested a ‘health and care premium’ but this would equally still be a form of tax.

The older generation has already paid into the ‘pot’ for many years, with the majority starting work at the age of 15. Some question whether it is unfair to further tax them at a time when they need their money for retirement. Most of the people working at retirement age do so because they cannot afford to retire, so those extra pennies are important.

Manchester mayor, Andy Burnham believes that the wealthy, not the workers, should be taxed. Speaking on BBC’s Today Programme, Mr Burham resolutely stated his intention to stand by his former plan of taxing people’s estates by saying –

“I stand by it, I think it is a much fairer way to do this. I would ask all pensioners to make a contribution, so 10 percent of their estate. That would be to introduce the NHS principle to social care because everybody would be required to contribute and everyone would benefit. No one would have the threat of catastrophic costs hanging over them.”

Whatever your thoughts, whether it’s a good or bad move, the money does need to be recovered somehow.

What will I be paying from April 2022?

The table below will give you an idea of how much your contributions will increase, depending on your salary.

| Current annual salary | Current NI contributions (at 12%) | With a 1.25 percent increase (to 13.25%) | A difference of – |

|---|---|---|---|

| £10,000 | £52 | £57 | £5 |

| £20,000 | £1,252 | £1,382 | £130 |

| £30,000 | £2,452 | £2,707 | £255 |

| £40,000 | £3,652 | £4,032 | £380 |

| £50,000 | £4,852 | £5,357 | £505 |

All things considered, paying extra per month out of your salary may not be too difficult for you to manage, but it can be a very stressful time for others. The rise in national insurance contributions will come only months after the removal of the Universal Credit uplift, designed to help people struggling during Covid.

If you feel you are struggling with debt, please visit Money Helper (formerly known as the Money Advice Service for expert help and guidance.