Looking for and worried about rejection? You’re not alone wanting a bad credit short term loans

Finding trustworthy lenders with a less-than-perfect credit score feels like searching for a needle in a haystack. The good news is that verified UK direct lenders will look at your application despite your past financial troubles. Cashfloat’s payday loans range from £300 to £1,500, and you can pay them back in 3 to 9 months. Their Representative APR sits between 295.58% and 1294%.

Like in Cashfloat’s case, Evlo welcomes applications from people who couldn’t get credit before. They offer loans from £1,000 to £15,000 with a Representative 99.9% APR.

Here’s something encouraging – most lenders can send you money right after approval. Most customers get their loan the same day. These services process more than 7500 no-obligation quotes every day. That means you have lots of options to explore without hurting your credit score.

This piece walks you through seven verified UK lenders who focus on bad credit short term loans. We’ll get into their features, who can apply, how to pay back, and what it costs. That way, you can pick the option that works best for your money situation.

Cashfloat

Cashfloat stands as a trusted direct lender in the UK digital world. This 9-year old company has helped over 150,000 people with their short-term borrowing needs. They excel at providing financial solutions if you have .less-than-perfect credit histories

Cashfloat loan features

Cashfloat’s payday loans range from £300 to £1,500. These loans help you handle unexpected expenses like emergency car repairs, surprise bills, or replacing broken appliances.

Their swift service makes them unique—you’ll spend just 3 minutes on applications. They make decisions within 30 minutes after submission. Your bank account receives the funds within an hour after approval.

The loan duration varies based on the borrowed amount:

| Loan Amount | Duration Options |

| £300-£350 | 3 months |

| £400-£450 | 3-4 months |

| £500-£900 | 3-6 months |

| £950 | 4-6 months |

| £1000-£1100 | 4-9 months |

| £1200-£1300 | 5-9 months |

| £1400-£1500 | 6-9 months |

Their innovative “Easy Start” option stands out. This feature reduces your first monthly payment and adds an extra interest-free month to your repayment plan. Managing your finances becomes easier right after borrowing.

Cashfloat eligibility for bad credit

Cashfloat’s bad credit short term loans need these simple criteria:

- UK residency

- UK bank account

- 18 years or older

- Steady income source

Your affordability matters more than credit score during application evaluation. Cashfloat sees your credit score as “just a number” and reviews your application based on your repayment ability. Benefits can contribute to your income, but you need additional regular earnings to qualify.

New borrowers usually get approved for loans around £700. Approval isn’t guaranteed, but you can boost your chances. Make sure you’re registered to vote at your application address and provide complete information. Don’t apply to many other lenders simultaneously.

Cashfloat repayment terms

Monthly repayments span 3 to 9 months. You pick which day suits you best for repayments during application. The company’s Continuous Payment Authority (CPA) lines up with your salary payment days.

They take a unique approach to early repayments. Unlike their competitors, Cashfloat doesn’t charge fees or penalties for early repayment. They encourage customers to repay early since this cuts down the total interest.

Contact their customer service team ahead of time if you expect repayment troubles. They’ll negotiate a new repayment plan that fits your circumstances better and helps avoid late payment penalties.

Cashfloat APR and fees

Cashfloat’s payday loan products come with a representative APR of 611.74%. Their personal loans show a lower representative APR at 295.58%. The daily interest rate stays capped at 0.8%, meeting regulatory requirements.

Here’s a clear example: A £700 loan for 6 months starts with a £168.45 first monthly repayment. Four monthly payments of £224.60 follow, ending with a final £112.20 payment. Total repayment reaches £1,179.05 with a 185.39% p.a. fixed interest rate.

Cashfloat keeps fees transparent without hidden charges. They send an arrears letter if you miss a payment. A £15 late payment fee adds to your balance the day after a missed repayment. Interest continues to build up to the daily capped limit.

Cashfloat’s interest rates might look high next to traditional lending options. Yet they offer competitive terms in the bad credit short term loans market. Their flexible repayment options and customer-focused approach make them stand out.

Fund Ourselves

Image Source: fundourselves.com

Fund Ourselves connects borrowers directly with investors in the UK as a . The platform has provided financial services since 2015, previously operating under the name WeLendUs until 2019. They are a peer-to-peer lender

Fund Ourselves loan features

You can borrow between £100 and £800 as a new customer if you have bad credit short term loans needs. Existing customers can request up to £1,500. The platform is easy to use. You will spend only 5 minutes on your application. You usually get a decision in a few minutes.

Money reaches you quickly with Fund Ourselves. Successful applications submitted before 10pm receive same-day transfers. Most borrowers see the money in their account within an hour of approval.

The platform stands out with these customer-friendly features:

- No hidden costs or fees

- Flexible repayment options

- Zero early repayment penalties

These features make Fund Ourselves a great choice if you need quick access to funds during temporary financial challenges.

Fund Ourselves eligibility for bad credit

You need to meet these simple requirements to apply for a Fund Ourselves loan:

- 18 years of age or older

- Current UK resident

- Regular income source

- Active UK bank account

Fund Ourselves takes a more welcoming approach to credit scores compared to traditional lenders. They “accommodate those with less than perfect credit scores, whilst maintaining affordable rates”. You might still qualify even with “not-so-good credit”.

The platform has some restrictions though. They will not take applications from people with County Court Judgments (CCJs), Individual Voluntary Arrangements (IVAs), or anyone who has gone bankrupt.

They look for signs that applicants are “actively trying to improve the way they manage their finances”.

Fund Ourselves repayment terms

Loans typically last four to six months. You’ll make equal monthly payments through direct debit during this period. The application lets you pick your preferred repayment schedule and first payment date.

The repayment structure gives you plenty of flexibility. You won’t face any penalties for early repayment, which could help you save on interest. The company offers a 12-month extension if you struggle with payments. This requires another credit check and means paying more interest overall.

Fund Ourselves APR and fees

The representative APR stands at 1,310.4%. Here’s what that means in real terms: borrowing £300 for 106 days (about 4 months) means repaying £501.69 in four monthly installments of £125.43. Another example shows the same amount over the same period would need repayments totaling £452.97.

Interest rates max out at 0.8% daily, matching UK regulations. The fixed annual interest rate is 176%, which explains the high APR calculation over a full year.

Fund Ourselves emphasizes transparency about costs. They promise “no hidden costs or fees” and no early repayment charges. This approach has earned them positive feedback on Trust Pilot, with a 4.0/5 rating from 2,970 reviews as of November 2024.

Remember that missing payments can result in extra charges and hurt your credit score.

LoanPig

Image Source: Direct Lender Loans from LoanPig

LoanPig stands out in the UK market as both a direct lender and broker for bad credit short term loans. This unique setup gives you better chances of approval, even if other lenders have turned you down.

LoanPig loan features

LoanPig offers loans between £50 and £1,500. These loans help people who need quick financial support. You can complete the entire application online through their website in minutes.

Key features of LoanPig loans include:

- Quick application from your smartphone, tablet, or computer

- Money in your account the same day when approved before 3 pm Monday-Friday

- Their service comes with no upfront fees

- You can apply without needing a guarantor

LoanPig’s two-tiered system sets them apart from other lenders. They first look at your application as a direct lender. If they cannot approve you right away, they will connect you with trusted lenders in the UK. These lenders may offer you better terms.

LoanPig eligibility for bad credit

You need to meet these simple requirements to qualify for a LoanPig loan:

- Your age should be 18 or above

- You must live in the UK

- You should have a steady job or regular income from benefits or pension

- A valid debit card and UK bank account are necessary

LoanPig welcomes people with poor credit histories. They look at your current financial situation instead of just focusing on past credit issues. Their motto “you are not your credit score” shows they believe past financial troubles shouldn’t stop you from getting credit now.

The application needs details about your income, expenses, and overall money situation. This helps them check if you can afford the loan responsibly.

LoanPig repayment terms

You can choose to repay your loan over 1 to 12 months. This lets you pick a timeline that works best with your finances. Most people find a 3-month payday loan works well.

Once approved, payments come directly from your bank account through Continuous Payment Authority. You can pay off your loan early without any extra charges, which could save you money on interest.

LoanPig wants you to contact them right away if you’re struggling with payments. They can help arrange a different payment plan to avoid extra fees and protect your credit score.

LoanPig APR and fees

The rates LoanPig ranges from 49.9% to 1261% representative APR Their daily interest stays at or below 0.8%, following UK rules

Here’s a real example: borrowing £300 for 3 months at 0.8% daily interest means paying back £457.95 in three monthly payments of £152.65.

LoanPig keeps their fees clear and simple:

- No fees to apply

- No charges for early repayment

- No fees for arranging a guarantor

New customers usually start with smaller loans. You might get approved for larger amounts after showing good payment history.

LoanPig does check your credit as part of their review. They care more about whether you can afford payments now rather than your credit score alone.

The interest rates might seem high compared to regular bank loans, but they compete well in the bad credit short term loan market. These loans work best for short-term money needs rather than long-term borrowing.

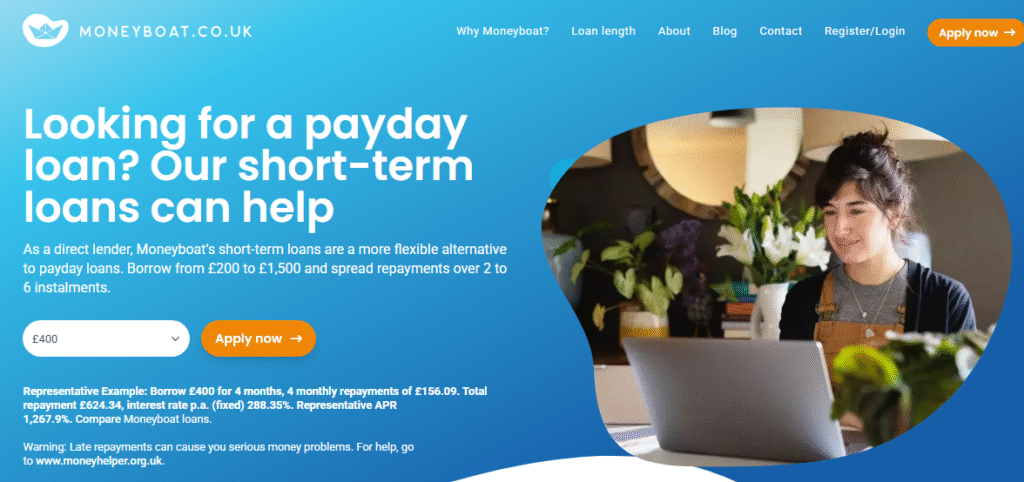

Moneyboat

Moneyboat is a UK-based direct lender that provides flexible . They have clear terms and transparent costs. You might want to check them out if you need quick financial help for short-term lending solutions

Moneyboat loan features

New customers can borrow between £200 and £800 from Moneyboat. Returning customers may borrow up to £1,500 if they pass credit and affordability checks.

The best part? Once they approve your loan, the money can be in your account in just 15 minutes.

Moneyboat is different from typical payday lenders because they give you more flexible repayment options. You can pay back their short-term loans over 2-6 months, which gives you more breathing room than single-payment payday loans. You’ll also get:

- No hidden fees or extra costs

- No early repayment penalties

- A clear daily interest rate of 0.79%

What makes them stand out is that they’re your direct lender from start to finish. This means you’ll deal with the same company throughout the process. Everything runs smoothly without broker fees or third-party hassles.

Moneyboat eligibility for bad credit

Here’s what you need to qualify for a Moneyboat loan:

- You must be at least 18 years old

- You need to be hired (full or part-time)

- Your net monthly income should be at least £1,000

- You should have a UK bank account and debit card

Moneyboat takes an integrated approach to bad credit applications. They do run credit checks during assessment, but they look at many factors beyond your credit score. A lower credit score won’t automatically disqualify you.

Worried about your credit history? Moneyboat says they “assess each application on its own merit”. They might ask for extra documents like bank statements or payslips to see if you can manage the loan.

Moneyboat repayment terms

The loan repayments spread over 2-6 months, and they arrange installments with your payday schedule. Your first installment comes at least five days after you get the loan, so you have time to prepare.

One great thing about Moneyboat is that you can make early repayments without penalties. This means you could pay off the entire loan on your next payday if you have the money, which could save you interest.

If you’re struggling to make a payment, reach out to their customer service team right away. They might adjust your repayment plan to make it more manageable and help you avoid extra charges.

Moneyboat APR and fees

The representative APR at Moneyboat is 1,267.9%, with a daily interest rate of 0.79%. This rate sits just below the industry cap of 0.8%. Let’s break down the cost: if you borrow £400 for 4 months, you’ll make three monthly payments of £156.09 and one final payment of £156.07, totaling £624.34.

Here’s what you won’t pay with Moneyboat:

- No application fees

- No early repayment penalties

- No hidden charges

Just keep in mind that missing payments could cost you a £15 fee if you don’t pay within three days of the due date. Interest keeps adding up on any unpaid balance until you clear it, which could make the total cost much higher.

Remember, Moneyboat loans work best for short-term money needs – they’re not a long-term fix. If you need help with ongoing financial issues, organizations like StepChange or MoneyHelper are there to support you.

Mr Lender

Image Source: Mr Lender

Mr. Lender is a company that has been around for 14 years. It is different from other places that offer short-term loans for bad credit. This is because it has a special way of reducing payments over time. This direct lender’s track record shows over 30,000 5-star reviews from UK customers over the last decade.

Mr Lender loan features

Mr Lender offers short term loans from £200 to £1,000, and you can pay them back in 3 to 6 months. New customers can borrow up to £500, and returning customers might get higher amounts. The best part? Once you’re approved, the money usually hits your bank account within an hour.

What makes Mr Lender loans special is their decreasing monthly repayment structure. Your monthly payments get smaller as time goes by, instead of staying the same each month. This is different from other lenders who ask for equal monthly payments.

The core features are:

- No upfront fees whatsoever

- No late payment fees

- Complete online application process

- Option to repay early at any time

Mr Lender eligibility for bad credit

You can get a loan from Mr Lender if you:

- Live in the UK

- Are hired (full or part-time) and earn at least £800 monthly after tax

- Are 18 or older

- Have a valid debit card linked to your bank account

Mr Lender looks at applications from people with less-than-perfect credit histories. They will not lend to anyone who has County Court Judgments (CCJs), Individual Voluntary Arrangements (IVAs), or bankruptcy from the last 3 years.

The company runs credit checks and checks if you can afford the loan. Mr. Lender says their loans are not good for people who have money problems or need to borrow for a long time.

Mr Lender repayment terms

You’ll pay back your loan on your pay date, which you agree to when you apply. Mr Lender uses Continuous Payment Authority (CPA) to collect payments from your debit account.

The company sends helpful email and text reminders before each payment is due. The customer service team can help if you need to change your payment date.

Here’s an example of the decreasing payment structure for a £ over 6 months:300 loan

| Month | Payment Amount |

| 1 | £122.00 |

| 2 | £110.00 |

| 3 | £98.00 |

| 4 | £86.00 |

| 5 | £74.00 |

| 6 | £62.00 |

Mr. Lender does not charge late or default fees if you miss payments. They could charge up to £15 for each missed payment, but they choose not to do so. Daily interest keeps adding up on any unpaid balance until you pay it back.

Mr Lender APR and fees

Mr Lender’s representative APR is 1,256.4%, and the maximum APR is 1,462.3%. The daily interest rate sits at 0.80% on outstanding capital, which means a fixed annual interest rate of 292%.

Let’s break it down: if you borrow £300 for 6 months, you’ll pay back £552.00 total, based on 30-day periods. This amount has £300 in capital and £252.00 in interest.

You only pay interest for the days you have the loan. Paying early can cut down your total cost by a lot because you only pay daily interest on what you still owe.

The APR might look high, but it reflects these loans’ short-term nature. The company keeps things simple with no upfront fees and no late payment fees. This makes them a clear choice for people looking for bad credit short term loans from direct lenders.

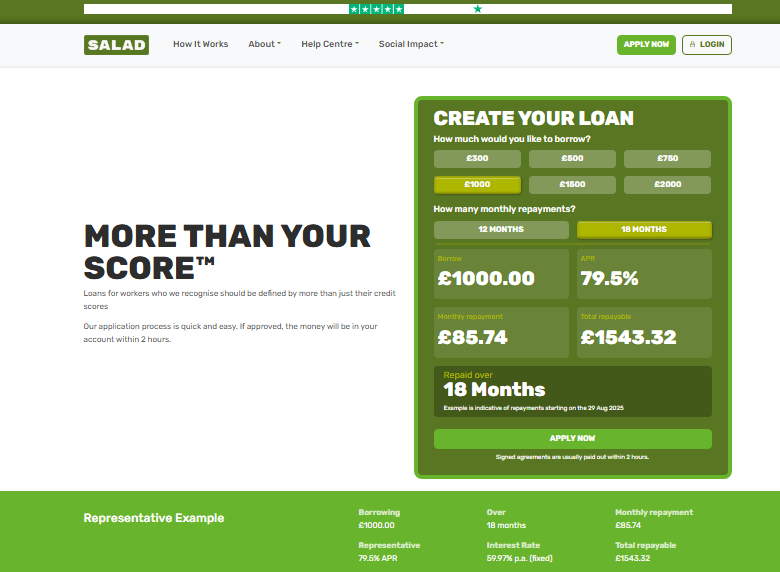

Salad Money

Salad takes a fresh approach to bad credit short term loans through their “More Than Your Score” program by using technology instead of traditional credit checks. This UK-based direct lender helps borrowers who have struggled with credit in the past and use Open Banking

Salad loan features

You can borrow between £300 and £2,000 from Salad, and they’ll deposit the money in your account within 2 hours of approval. The application process is easy. Choose how much money you want to borrow. Create an account. Link your Open Banking data. Then, wait up to one business day for a decision.

This quick service helps customers who need money fast.

These loans don’t require any collateral since they’re unsecured. Salad’s “More Than Your Score” loans are specifically designed to help people facing urgent money problems.

Salad eligibility for bad credit

Salad’s requirements include:

- Being over 18 years old

- Being hired by your current employer for at least 6 months

- Earning over £1,500 per month

- Having access to your online bank account where you receive wages

Your credit score doesn’t affect Salad’s decision. They assess your income and spending patterns through Open Banking data instead. You may still qualify even if you have credit problems, like Individual Voluntary Arrangements from more than a year ago or County Court Judgments from over six months ago.

Salad repayment terms

Salad offers different repayment options based on loan size:

- £500, £750, and £1,000 loans: 12 or 18 months

- £1,500 and £2,000 loans: 18 or 24 months

Salad’s customers can save on interest by making early repayments or overpayments without any fees.

Salad APR and fees

Salad’s representative APR ranges from 59.9% to 79.5%, depending on how much you borrow and for how long. A £1,000 loan over 18 months would cost £86.41 monthly, with a total repayable amount of £1,555.38 at a representative 79.5% APR.

These rates might seem steep compared to regular loans, but they’re competitive in the bad credit short term loan market. Salad’s approach looks beyond credit scores and offers a good option for people who need financial help despite past problems.

Savvy

This lender is a Stockport-based lender, offers to borrowers who have less-than-perfect credit histories. Their big win as Responsible Lender of the Year at the 2019 Credit Strategy Awards shows their strong commitment to fair lending practice, providing financial solutions

Savvy loan features

Savvy’s loans range from £300 to £1,200, with credit and affordability checks. They focus on assisting people with below-average credit history. This makes them a good option if you have trouble getting financing anywhere else.

Customers who get approved usually receive their funds during business hours Monday through Saturday. The company sends money within one hour on weekdays and Saturdays after approval.

Savvy eligibility for bad credit

You need these things to get a Savvy loan:

- Be over 18 years old

- Be a UK resident

- Have a UK bank account and debit card

- Earn a minimum net income of £1,000 monthly

It’s worth mentioning that Savvy looks at applications from people with poor credit ratings. You might still get approved even with a county court judgment against your name. Notwithstanding that, your ability to repay comfortably remains their main goal in decision-making.

Savvy repayment terms

Savvy’s repayment period changes based on how much you borrow:

| Loan amount | Repayment term |

| £300-£500 | 6 months |

| £501-£700 | 8 months |

| £701-£900 | 10 months |

| £901-£1,200 | 12 months |

Savvy’s Trustpilot rating stands at “Excellent” as of February 2025. Their customer satisfaction shows in the numbers – 77% of their reviews are 5-star.

Savvy APR and fees

The changes with loan amounts and the Representative APR:

- £300-£500: 1,290.2% APR

- £501-£700: 731.0% APR

- £701-£900: 471.5% APR

- £901-£1,200: 332.0% APR

These rates might look high compared to traditional loans, but they drop by a lot as you borrow more. Larger loans become more budget-friendly for people who need substantial short-term funding through this tiered structure.

Comparison Table

| Lender | Loan Amount Range | Repayment Terms | Representative APR | Funding Speed | Key Features | Minimum Income |

| Cashfloat | £300-£1,500 | 3-9 months | 611.74% | Within 1 hour | Easy Start option with reduced first payment; No early repayment fees | Not mentioned |

| Fund Ourselves | £100-£800 (new); Up to £1,500 (existing) | 4-6 months | 1,310.4% | Same day (before 10pm) | No hidden fees; No early repayment penalties | Regular income required |

| LoanPig | £50-£1,500 | 1-12 months | 49.9%-1261% | Same day (before 3pm) | Acts as both direct lender and broker; No upfront fees | Not mentioned |

| Moneyboat | £200-£800 (new); Up to £1,500 (existing) | 2-6 months | 1,267.9% | Within 15 minutes | No hidden fees; Direct lender throughout process | £1,000 monthly |

| Mr Lender | £200-£1,000 | 3-6 months | 1,256.4% | Within 1 hour | Decreasing monthly repayments; No late payment fees | £800 monthly |

| Salad | £300-£2,000 | 12-24 months | 59.9%-79.5% | Within 2 hours | Uses Open Banking instead of credit checks; No early repayment fees | £1,500 monthly |

| Savvy | £300-£1,200 | 6-12 months | 332.0%-1,290.2% | Within 1 hour | Specializes in lower credit histories; Tiered APR structure | £1,000 monthly |

Conclusion

The seven trusted UK lenders listed above provide good options for bad credit short term loans, even if finding them feels daunting. These lenders have unique features that could work well for your situation. Cashfloat’s “Easy Start” payment plan and Salad’s innovative Open Banking system look beyond traditional credit scores. Monthly income requirements start at £800 and go up to £1,500, with loan amounts ranging from £50 to £2,000.

The higher APRs make sense because these loans are short-term and riskier than traditional ones. Make sure you check the total amount you’ll need to pay back before signing anything. These lenders let you pay back early without extra fees, which could save you money on interest.

Your specific needs should guide your choice of lender. The speed of funding, repayment period, and qualifying criteria all matter. Our comparison table helps narrow down your choices based on what’s important to you. We partner with the UK’s top lenders to boost your chances of approval, so apply with us today.

These loans work best to bridge temporary money gaps rather than fix long-term issues. Take an honest look at whether you can handle the repayments without causing more financial stress. A careful comparison of options helps you find the right loan and avoid extra costs or rejected applications.

Key Takeaways

- The article explores bad credit short term loans from seven verified UK lenders, emphasizing their unique features and eligibility criteria.

- Cashfloat, Fund Ourselves, LoanPig, Moneyboat, Mr Lender, Salad, and Savvy each offer distinctive loan amounts and terms for those with less-than-perfect credit.

- Most lenders provide quick access to funds, often on the same day, with no hidden fees or early repayment penalties.

- Higher representative APRs reflect the risk of short-term loans, with ranges from 49.9% to 1,310.4%.

- borrowers can improve their chances by applying with accurate information and understanding their financial ability to repay.